GameStonk Gains

How one investment with massive returns had a junior dominating RHS stock market competition

More stories from Emily Broad

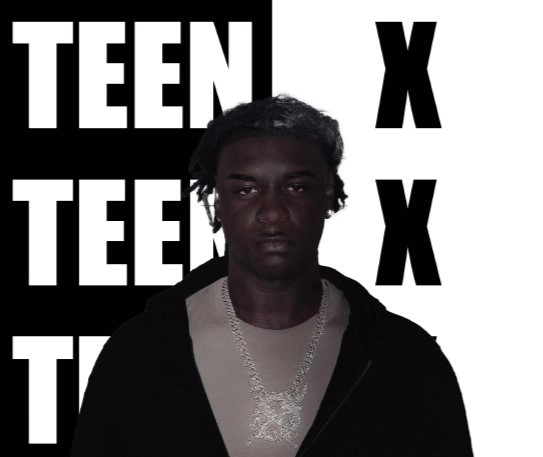

Photo taken by Emily Broad

Check out our podcast to listen to host Emily Broad’s interview with RHS junior and AP Microeconomics student Treyger Lawason!

Over the past few weeks, the GameStop Corp. (GME) stock value has increased at an unprecedented pace and the growth has created a dramatic shift in the standings of this year’s virtual stock market competition. The competition is a tradition for Rocklin High School students taking AP microeconomics, but the fluctuation in GME share price has meant the standings from this year are unlike any before.

The rapid growth of GME stock price is unprecedented because the COVID-19 pandemic has limited shopping at GameStop retail stores. Additionally, many people have lost their jobs and are less willing and able to buy video games and consoles, leading to a decrease in sales overall for the company. According to the GameStop website, their earnings from the third quarter of 2020 were down over 30% from what they had been the previous year. These trends led hedge funds to anticipate a decrease in GME stock value, further leading them to short shares.

As an investor would short shares of any stock, hedge funds like Melvin Capital promised to purchase positions in the stock soon in exchange for being able to sell their shares for the current market price later. That way, they could make money off of selling their positions for the higher price, instead of the lower price as the stock declined. It was such a compelling opportunity that a number of hedge funds shorted large positions, something that the subReddit WallStreetBets picked up on.

This is noteworthy because WallStreetBets had previously been a group of individuals who struggled with investing and would lament about their poor financial decisions. However, combined with investing apps like Robinhood and the power of Twitter, these small investors were able to change the price of GME stock by a staggering amount, nearly 2000% on just Jan. 27.

So, instead of the decrease in stock price, there was a rise in individual investments in GME positions that drove the price of GME stock even higher. This rise led to hedge funds who tried to short GME losing over $5 billion as the price increased from the price they bought it at and in turn created a short squeeze where big investors had to buy the stock at a higher price than they could sell at.

“This creates a dilemma for these big short sellers who have big short positions,” said AP microeconomics teacher Mr. Mark Hardy, “they see the price rise… and they have to make a decision at that point whether to wait and hope it comes back down or cover their shorts. They basically, in a sense, are forced to buy the stock to limit their loses. This causes the stock to go even higher.”

When junior Treyger Lawanson started in the virtual stock market game, he browsed Reddit for investment advice and after reading some threads on WallStreetBets, he bought nearly 300 shares of GME on Jan. 19. “I invested when it first had a little spike but it was nothing where people were following it, people who had nothing to do with the stock market,” Treyger said.

Despite having already been in the number one slot of the competition because of his successful investment in Blackberry shares, the dramatic increase in value of GME meant that Treyger’s returns on Jan. 27 were over 165% and were historic for the competition.

“I don’t want to say that it was all skill,” said Treyger, “because it definitely wasn’t. I totally got lucky on this one… I was a little better informed that everyone else thought. That and a little bit of luck really helped.”

These trends with GameStop worry Hardy, “What we have is a few people that have taken a huge lead in each of my classes, and that bums me out a little bit because it has caused some people to kind of lose interest.” With Treyger having been so far ahead, Hardy was concerned that students would feel they couldn’t catch up and then not put any effort into their portfolios.

He is mainly concerned that students will start investing in stocks they expect to have short-term high returns instead of in ones that will steadily increase in value over time, “I don’t want my students to learn that this is the main way you make money in stocks, through some crazy fluctuation and trying to time it right. I want to teach more long term steady investing in quality companies that will gain you money over time.”

As for the long term effects of this change in the market, Treyger feels that, “There’s definitely going to be change, but I’m just not experienced enough to understand the true scope of that change… In the long term, I would say that you’re going to see these larger firms being a bit more cautious.” For now, GME prices are still fluctuating dramatically and it remains to be seen what the long term effects will be on the company’s stock.